One question I am asked often at this time of year, tax time, is what paperwork needs to be kept and for how long. It can be confusing what’s important or not. My hubby, Scotty, is an accountant. He put together a list of paperwork you need to keep for your individual tax return for me to share with you. Sometimes through the year we are unsure what will be relevant or not, so this will be handy to have to keep track. I have also shared below an idea on how you can keep your tax paperwork, bills and receipts organised throughout the year as keeping everything tidily together to not misplace a receipt, will help you get the most money back at tax time.

Many like to put off tax time but you will thank yourself for getting it done sooner rather than later. Put a date in your calendar today to sit down and sort it all out so you won’t end up rushed before the due date.

How long to keep tax paperwork, bills and receipts?

It is recommended to keep all paperwork related to your tax for up to five years, just in case you ever need to show how you arrived at these figures.

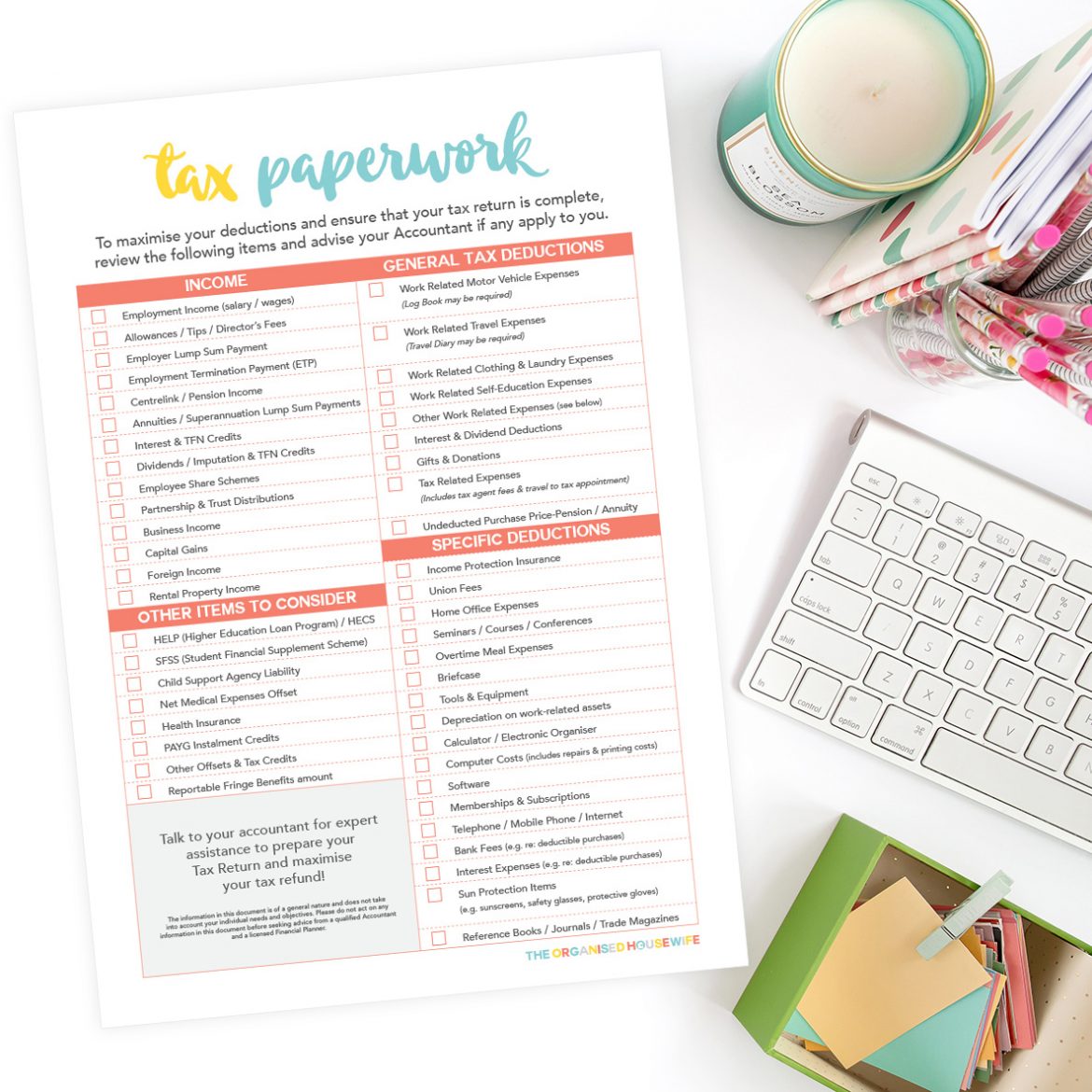

Tax Return Paperwork Checklist

Your accountant should give you a list of all the paperwork they recommend you to consider for your tax return. For your convenience and with Scotty’s help, I have put together this list for you to print and have on hand. Available here.

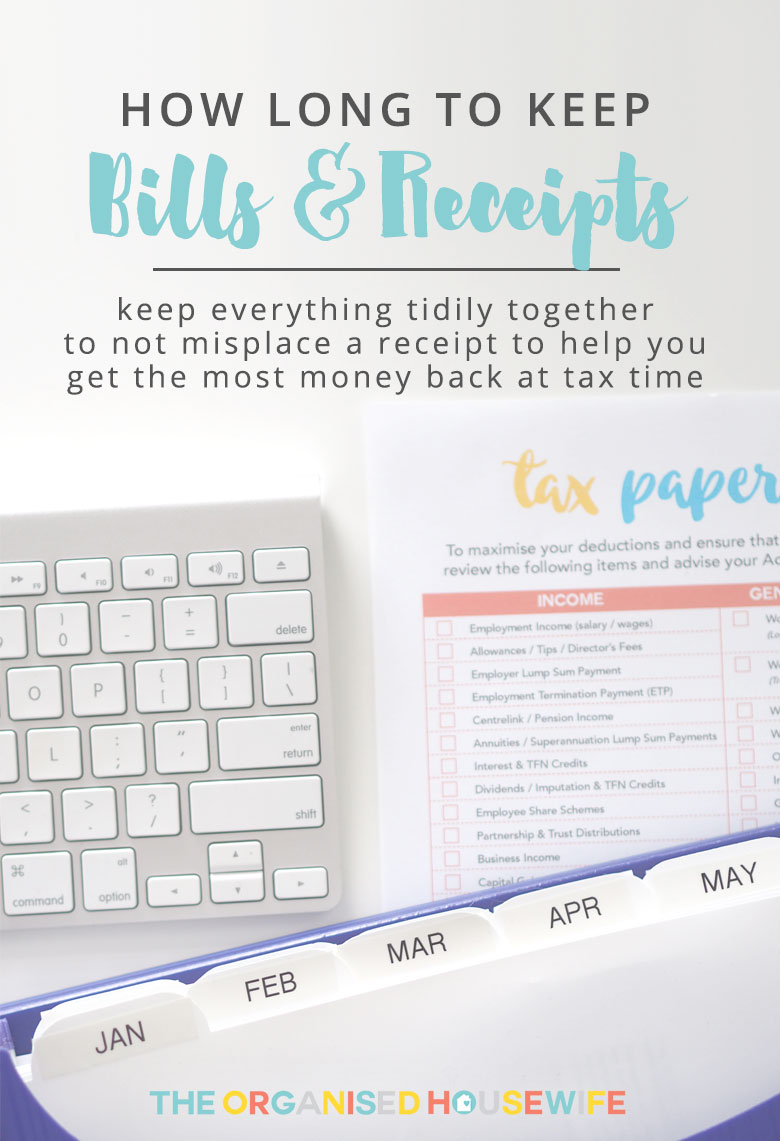

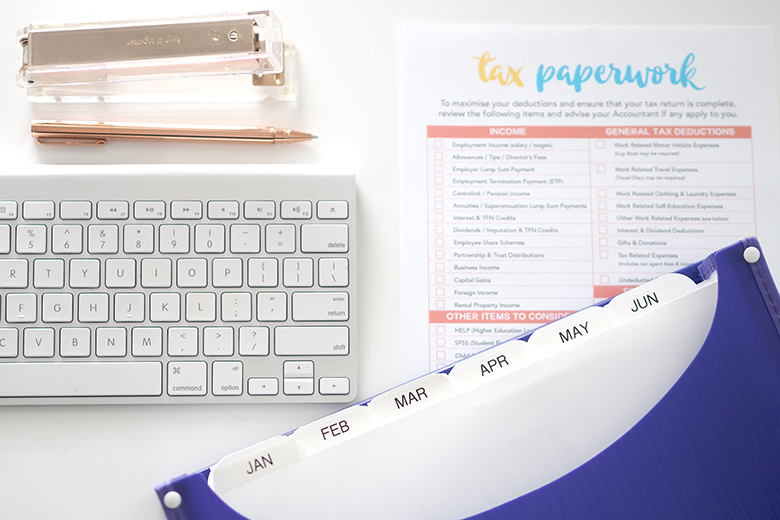

How to store your tax paperwork

The key to making tax time stress free is to keep your paperwork organised throughout the year. This will save you so much time and sanity. There are two options in how to organise your files:

- By month

- By categories. ie. expenses, income, etc.

I helped a friend of mine who owns her own business (a driving school here on the Gold Coast, if you need one she’s your girl!) organise her tax filing system. I chatted to Scotty about the best way to file her paperwork. He thought about some of his clients who often need a receipt to return items or for warranty and they find it more easily within their filing system when it’s filed by month. Use the method that suits you, as this filing system is just for your records. Your accountant shouldn’t need any of the receipts as you should send details in digital form.

I purchased this expansion file from Officeworks and used my labeller to place on labels for each month. If your business is bigger you may need to use some hanging files in a filing cabinet.

Once you have completed your tax paperwork for the year, place each month into plastic sleeves and file the year away tidily with the previous year’s tax paperwork so you can easily locate it if needed. You can file these away together in a filing cabinet, archive boxes, plastic storage boxes.

See the Australian Taxation Office for more details about keeping your tax records.